impossible foods ipo price

Smithfield Foods Inc is a pork producer and food-processing company based in Smithfield Virginia in the United States and a wholly owned subsidiary of WH Group of China. The IPO was the eighth largest for an Israeli company on the NASDAQ and during the year 2010 one of the top-performing IPOs generally.

Impossible Foods Eyes 7b Valuation Founder Hints At Inevitable Ipo

Supply from UP prevents price surge Sugar exports jump 277 to 17 lakh tonnes in Oct-Dec 2021-22 season ISMA says sweetener output up 6 per cent till mid-January.

. In addition to owning over 500 farms in the US. Excluding the purchase price of the machine typical cost to the end user 2015. Impossible Foods IPO.

Impossible Foods has said it will eventually go public which could mean a 2022 IPO is likely to happen. Founded in 1936 as the Smithfield Packing Company by Joseph W. To celebrate SodaStreams listing on the NASDAQ CEO Daniel Birnbaum was invited to ring the exchanges closing bell on 3 November 2010.

One of the hottest IPOs in 2022 might be a. Led by chief executive founder and former Stanford professor Pat Brown Impossible Foods may be open to the public for investment. Luter and his son the company is the largest pig and pork producer in the world.

Impossible Foods Ipo How To Invest In Impossible Foods Vegpreneur

Impossible Foods Reportedly Preparing For Ipo With Us 10 Billion Valuation

Impossible Foods Eyes 7b Valuation Founder Hints At Inevitable Ipo

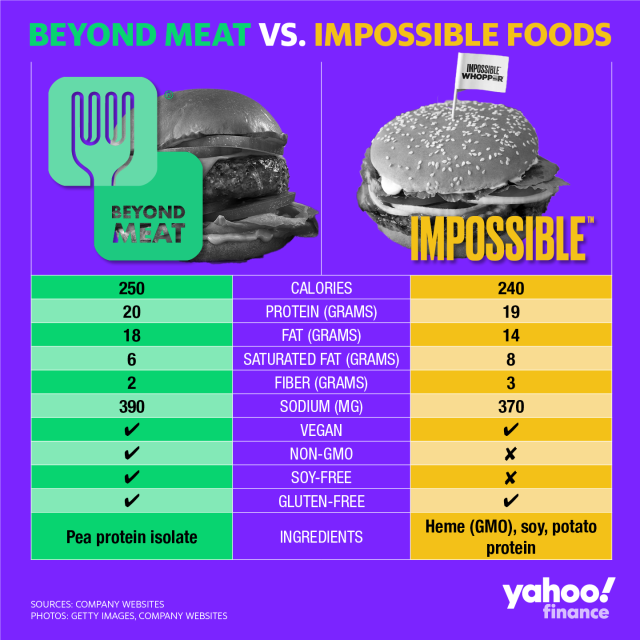

Beyond Meat Vs Impossible Foods Burger Nutrition Showdown

Impossible Foods This Could Be The Best Tech Ipo Of 2020

Impossible Foods Ipo Stock Analysis Buy Or Sell Youtube

Buying Impossible Foods Stock Will Be Possible Soon Investorplace

Why Impossible Foods Viability In Asia Is Key To Its Highly Anticipated Ipo

/cdn.vox-cdn.com/uploads/chorus_asset/file/18368959/AP19211755669243.jpg)

Impossible Foods Turns To Aurora Based Osi Group To Expand Production Chicago Sun Times